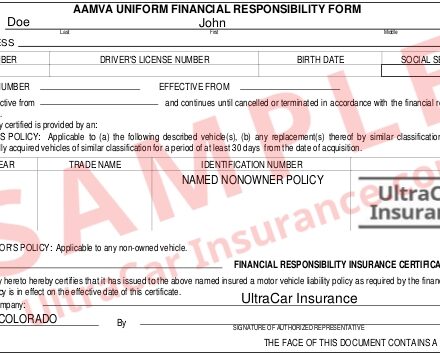

Nonetheless, a non-owner policy may not cover the lorry had or regularly used by the founded guilty driver. Although the danger to the lorry you are driving remains, the higher restrictions you acquire for a non-owner policy to cover will certainly offer you better assurance when it comes to a pricey mishap.

You do not require to possess an auto to acquire this sort of insurance policy. If you do not possess a cars and truck, ask your insurance coverage firm about a non-owner SR-22 policy. For many offenses, you must carry this sort of insurance coverage for three years from the finishing day of any revocation.

Every chauffeur is needed to have some minimum amount of insurance coverage in most states. This need is the basis of "mandatory car insurance policy legislation" which mentions that chauffeurs have to be economically liable by buying liability insurance coverage. Normally, the state DMV approves the vehicle proprietor's word for having actually the called for insurance policy.

The Best Guide To Sr22 Insurance: What Is Sr22 Insurance & Rates By State

The SR-22 certification is submitted directly with the state by your insurance coverage business. Infinity bills a fee to file this form - the costs vary by state. The finest method to discover the price connected with an SR-22 declaring is to acquire a quote from Infinity and also request an SR-22.

The insurer is required to tell the state if the insurance policy is cancelled. Failing to keep the SR-22 declaring may lead to the loss of your permit.

Virginia SR-22 as well as FR-44 Insurance Policy: Information as well as Average Costs, Generally, SR-22 and also FR-44 insurance policy expense greater than common policies as a result of the severity of the associated traffic violation. For a minimum policy insurance coverage for FR-44 insurance coverage in Virginia, the ordinary price is $772 per year. That's $349 greater than the yearly typical cost for a common plan for a motorist with a tidy record of $423.

The smart Trick of 10 Best Sr-22 Insurance Companies Of 2021 That Nobody is Discussing

What Is SR-22 and FR-44 Insurance in Virginia? FR-44 as well as SR-22 insurance coverage in Virginia as well as elsewhere are not types of auto insurance plans.

While these motorists might experience some rises in their premiums, their prices will not be as high as policies for motorists that need either an SR-22 or FR-44. The length of time you need SR-22 or FR-44 insurance in Virginia depends upon the seriousness of your sentence. In many cases, chauffeurs need to maintain an SR-22 or FR-44 for 3 years.

The carrier with the second-lowest rate is State Farm, at $306 per year generally. The average expense of non-owner insurance policy in the state is $659 each year. Scroll for even more Show extra, The prices utilized by Cash, Geek in this analysis are for Virginia vehicle drivers with a DUI buying automobile insurance coverage with $50,000 physical Have a peek here injury responsibility protection per individual, $100,000 in physical injury liability protection per crash and also a property damages responsibility coverage of $50,000 per mishap.

The Only Guide to Compare Sr22 Insurance Quotes – Drinkdriving.org

Discover answers to these and more listed below. EXPAND ALLWhat is an SR-22 or FR-44 in Virginia? SR-22 insurance policy in Virginia is a need for chauffeurs convicted of extreme traffic violations, like driving uninsured. It is a kind that accredits the motorist has insurance coverage that meets the minimum liability demands in the state.

This form needs that the insurance policy holder boosts their obligation limits. Where can Virginia drivers obtain an SR-22 or FR-44? Virginia motorists who need either SR-22 or FR-44 insurance policy will certainly have to request that their insurance coverage providers complete these forms. The insurance company will file the suitable type with the state in your place.

The typical cost for its state minimum need for an insurance holder with DUI is $434 per year. How much time do Virginia chauffeurs need an SR-22 or FR-44? The severity of the conviction figures out for how long a Virginia motorist requires an SR-22 or FR-44. In many cases, these types are required for 3 years.

Sr-22 “Drunk Driving Insurance” In South Carolina - Holland ... Can Be Fun For Anyone

An SR-22 is a certificate of financial duty that is mandated by the state as well as supplied by your auto insurance policy carrier, which specifies that your necessary automobile insurance coverage is in result. An SR-22 certification may be needed after a DUI apprehension and/or sentence as a need to restore any kind of driving benefits.

The real declaring of an SR-22 expenses around $25 in most states. Your auto insurance premium may additionally increase significantly. The demand for an SR-22 certification tells the insurance company that you are taken into consideration a risky vehicle driver and also risky drivers typically need non-standard insurance policies., and the expense is frequently greater for numerous years up until the motorist has had a clean driving record.